cryptocurrency market trends february 2025

Cryptocurrency market trends february 2025

So far, SUI had the largest token unlock on February 1, at 331 million, representing 2.6% of the total supply. Other significant token unlocks will be from SAND on February 14, (110 million), APT today, February 12 (89 million), and MELANIA on February 20 (74 million) https://reddog6.com/.

Onchain governance will see a resurgence, with applications experimenting with futarchic governance models. Total active voters will increase by at least 20%. Onchain governance has historically faced two problems: 1) lack of participation, and 2) lack of vote diversity with most proposals passing by landslides. Easing regulatory tension, which has been a gating factor to voting onchain, and the recent success of Polymarket suggests these two points are set to improve in 2025, however. In 2025, applications will begin turning away from traditional governance models and towards futarchic ones, improving vote diversity, and regulatory tailwinds adding a boost to governance participation. -Zack Pokorny

The losses experienced by major DeFi blue chips highlight the inherent risks and volatility associated with cryptocurrencies, especially in a rapidly evolving market. The poor performance in the DeSci, NFT, and GameFi sectors reflects market sentiment that may be reacting to broader economic factors or sector-specific challenges, impacting investment flows and interest levels in these innovative but still maturing areas.

Cryptocurrency market trends 2025

Galaxy and members of Galaxy Research may own the coins mentioned, including Bitcoin, Ether, and Dogecoin. Many more predictions were made and not shared, and many more could be made. These predictions are not investment advice, or an offer, recommendation, or solicitation to buy or sell any securities, including Galaxy securities. These predictions represent the point-in-time views of the Galaxy Research team as of December 2024 and do not necessarily reflect the views of Galaxy or any of its affiliates. These predictions will not be updated.

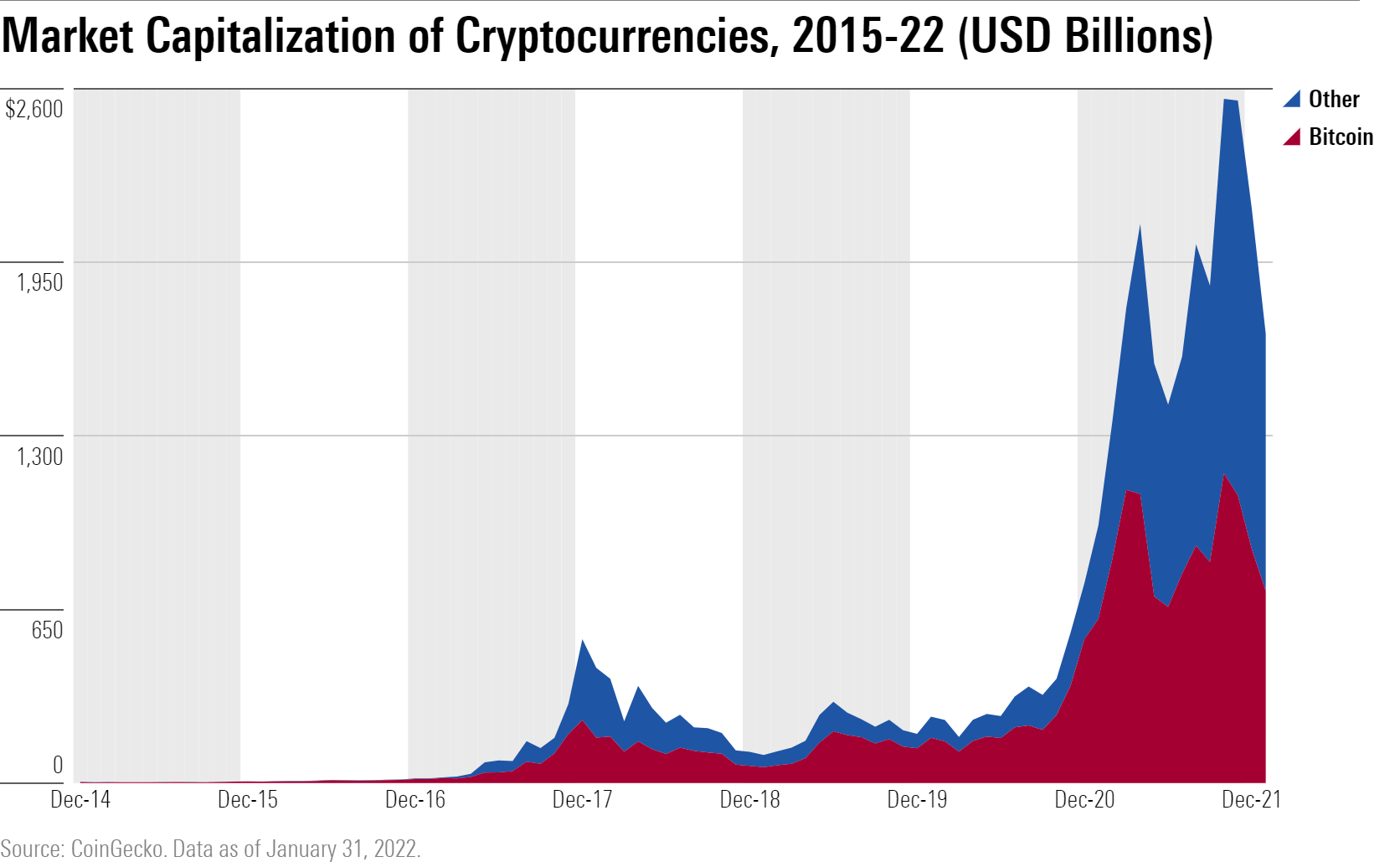

2024 saw a monumental shift for Bitcoin and digital assets. New products, record inflows, monumental policy shifts, growing adoption, and solidification of Bitcoin as an institutional asset marked 2024.

From fresh tariffs and risk-off sentiments to forward-looking policies and the establishment of a Crypto Task Force, 2025 reflects a time of both consolidation and expansion for cryptocurrencies. While it’s too soon to say if crypto will surge as it did in past bull runs, its increasing entrenchment in financial, governmental and technological spheres signals that the sector’s demand trends remain dynamic, complex and, for many, undeniably promising.

In Gemini’s 2025 Global State of Crypto Report, we analyzed the state of the crypto market and attitudes toward digital assets, including the impact of spot bitcoin ETFs, memecoins, how President Trump’s pro-crypto policies have impacted crypto attitudes, whether investors are planning to buy more in the coming year, and more.

More than two years on from the official end of the coronavirus pandemic, explore the lasting effects on consumer behavior. From E-commerce to mask-wearing, dive into the data on what has (and hasn’t) become the new normal for consumers.

Ethereum staking rate will exceed 50%. The Trump administration is likely to offer greater regulatory clarity and guidance for the crypto industry in the U.S. Among other outcomes, spot-based ETH ETPs will likely be allowed to stake some percentage of the ETH they hold on behalf of shareholders. Demand for staking will continue to rise next year and likely exceed half of Ethereum circulating supply by the end of 2025, which will prompt Ethereum developers to more seriously consider changes to network monetary policy. More importantly, the rise in staking will fuel greater demand and value flowing through Ethereum staking pools like Lido and Coinbase and restaking protocols like EigenLayer and Symbiotic. -Christine Kim

Latest cryptocurrency news may 2025

A blockchain-based mechanism, known as provably fair systems, allows crypto gambling sites to verify game fairness. The implementation of cryptographic algorithms enables players to check that game results remain untainted. It results in enhanced transparency during gambling sessions.

As of May 2025, the cryptocurrency landscape is experiencing significant shifts, marked by unprecedented price surges, increased institutional adoption, and emerging security concerns. This comprehensive overview delves into the most impactful developments shaping the crypto world today.

Decentralized finance keeps improving because it implements better security systems, which make it suitable for conventional investors while also following regulatory requirements. Modern lending, borrowing, and yield farming platforms have developed sophisticated features that provide banking alternatives to traditional financial institutions.

The increasing value of cryptocurrencies has unfortunately led to a rise in crypto-related crimes. A notable incident involves John Woeltz, a cryptocurrency investor accused of kidnapping and torturing an Italian tourist to extract Bitcoin passwords. This case highlights the growing need for enhanced security measures among crypto investors .

Financial institutions have demonstrated a continuous interest in digital assets, as they became one of the primary trends in 2025. Traditional financial institutions and investment companies that initially doubted crypto assets now implement blockchain technology in their business operations.

Laisser un commentaire